Emergence of Multi-Cloud Strategies

The Data Center Interconnect Market is significantly influenced by the growing adoption of multi-cloud strategies among enterprises. Organizations are increasingly leveraging multiple cloud service providers to optimize their operations, enhance flexibility, and mitigate risks associated with vendor lock-in. This trend necessitates efficient interconnect solutions that facilitate seamless data transfer between various cloud environments. As a result, the demand for interconnect technologies that support multi-cloud architectures is on the rise. Market analysts suggest that the multi-cloud market could reach a valuation of over 400 billion dollars by 2025, further underscoring the importance of robust interconnect solutions. The Data Center Interconnect Market must adapt to these evolving needs, offering solutions that ensure interoperability and high-performance connectivity across diverse cloud platforms.

Growing Importance of Edge Computing

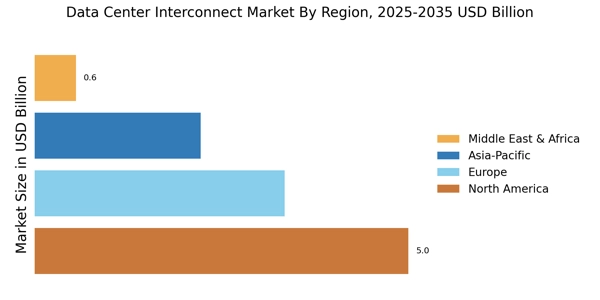

The Data Center Interconnect Market is being significantly impacted by the rising importance of edge computing. As organizations seek to process data closer to the source, the demand for interconnect solutions that support edge data centers is increasing. This shift is driven by the need for real-time data processing, reduced latency, and improved user experiences. The edge computing market is projected to grow substantially, with estimates suggesting it could reach over 15 billion dollars by 2025. This growth necessitates the development of interconnect solutions that can efficiently link edge data centers with core data centers, ensuring seamless data flow and operational efficiency. The Data Center Interconnect Market must adapt to this trend, providing innovative solutions that cater to the unique requirements of edge computing environments.

Increased Focus on Security and Compliance

The Data Center Interconnect Market is increasingly shaped by the heightened focus on security and compliance requirements. As data breaches and cyber threats become more prevalent, organizations are compelled to implement stringent security measures to protect sensitive information. This trend drives the demand for interconnect solutions that offer enhanced security features, such as encryption and secure access controls. Regulatory frameworks, such as GDPR and HIPAA, further necessitate compliance, influencing the design and implementation of data center interconnect solutions. The market for security-focused interconnect technologies is expected to grow significantly, as organizations prioritize safeguarding their data assets. Consequently, the Data Center Interconnect Market must evolve to provide solutions that not only meet performance standards but also adhere to rigorous security and compliance mandates.

Rising Data Traffic and Bandwidth Requirements

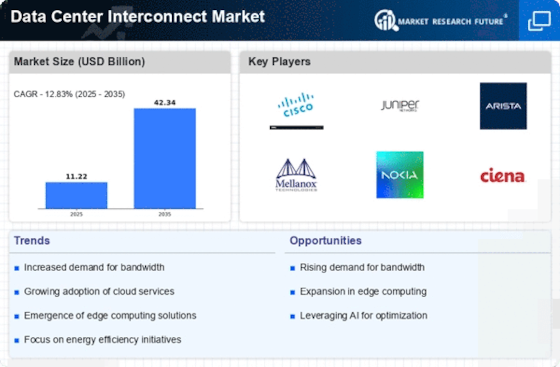

The Data Center Interconnect Market is experiencing a surge in demand driven by the exponential growth of data traffic. As organizations increasingly rely on cloud services and data-intensive applications, the need for high-capacity interconnect solutions becomes paramount. According to recent estimates, global data traffic is projected to reach 175 zettabytes by 2025, necessitating robust interconnect infrastructures. This trend compels data centers to enhance their connectivity capabilities, ensuring seamless data transfer and reduced latency. Consequently, service providers are investing in advanced technologies to meet these bandwidth requirements, thereby propelling the Data Center Interconnect Market forward. The integration of optical networking and high-speed Ethernet solutions is likely to play a crucial role in addressing these challenges, fostering a competitive landscape among service providers.

Technological Advancements in Networking Solutions

The Data Center Interconnect Market is witnessing transformative changes due to rapid technological advancements in networking solutions. Innovations such as 5G technology, optical networking, and artificial intelligence are reshaping the landscape of data center interconnectivity. These advancements enable higher data transfer rates, improved reliability, and enhanced network management capabilities. For instance, the implementation of 5G is expected to revolutionize data center interconnect solutions by providing ultra-low latency and increased bandwidth. As organizations seek to leverage these technologies, the Data Center Interconnect Market is likely to experience substantial growth. The integration of AI-driven analytics into networking solutions may further optimize performance, allowing for proactive management of network resources and improved operational efficiency.